Quarterly Review

The Sky Is Not Falling

Detailed Review

Detailed Review

(But we are experiencing turbulence)

With the S&P 500 down 20.0% through the first half of 2022, now is the right time to recall how far the market has appreciated since the Great Financial Crisis of 2008-2009. From the market bottom on March 13, 2009, through December 31, 2021, the total return for the S&P 500 was just over 715% (per FactSet). The market had brief pull backs in 2018 and again in March of 2020 due to Covid, but neither lasted more than one quarter. Knowing this makes the current two quarter decline uncomfortable by comparison.

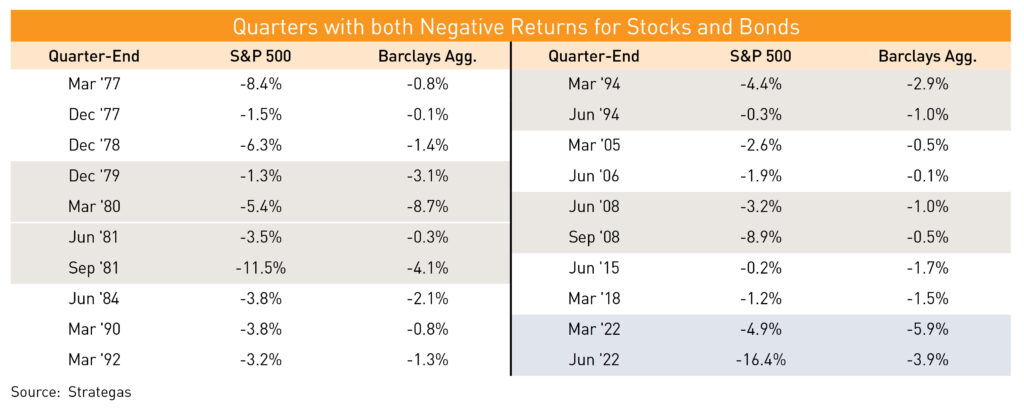

Blame ongoing concerns about inflation, supply chain issues, quickly rising interest rates, and the war in Ukraine for the brutal first half of 2022. Softening economic data later in the second quarter added to concerns the Fed might have to tighten the US economy into recession to get inflation under control. The rapid increase in interest rates since January has negatively impacted stocks and bonds; it is only the sixth time in 47 years that both bonds and stocks have reported negative returns in two straight quarters.

Meanwhile, the yield on the 10-year U.S Treasury has increased dramatically to just under 3% from 1.5% at the end of 2021. While these higher interest rates make holding fixed income more appealing now versus six months ago, it is important to note that bonds do not provide much purchasing power protection with inflation currently running more than 8%.

Higher food and energy prices are reducing consumers’ discretionary spending as more budgets go toward needs vs. wants. Fewer people are even attempting to purchase homes; mortgage demand fell in May to its lowest level in 22 years as rates rose. Refinancing demand is down more than 70% from one year ago.1 This drop in demand should help start to lower the inflation rate later this summer and reduce pressure on the Fed to maintain its aggressive rate increase posture. With a very strong job market and unemployment at only 3.5%, the Fed is aiming to bring down inflation without triggering a recession.

If there is a silver lining in this market drawdown, it is this: the valuation of the S&P 500 has returned to its historic average of 16-17x earnings from an expensive 22x earnings as of 12/31/21. Projected annualized five year returns for the S&P 500 as of year- end 2021 were only low to mid-single digits due to the elevated valuation caused by strong market performance over the last three years. With the return to a more average valuation for the S&P 500, the prospects for better five-year returns have improved moving forward.

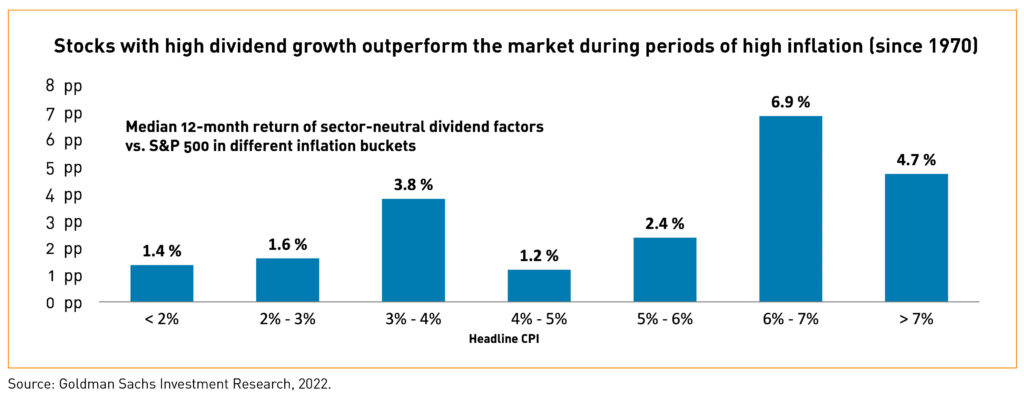

Dividend growth equities have meaningfully outperformed the broader market this year; high quality companies with growing cashflow and earnings are increasingly attractive given the economic and geopolitical uncertainty. Also, strong dividend income growth the last few years has protected clients’ purchasing power, even in these times of elevated inflation. It is worth noting, dividend growth companies have outperformed broader index returns across all inflationary timeframes going back to 1970, particularly during runaway inflationary periods.

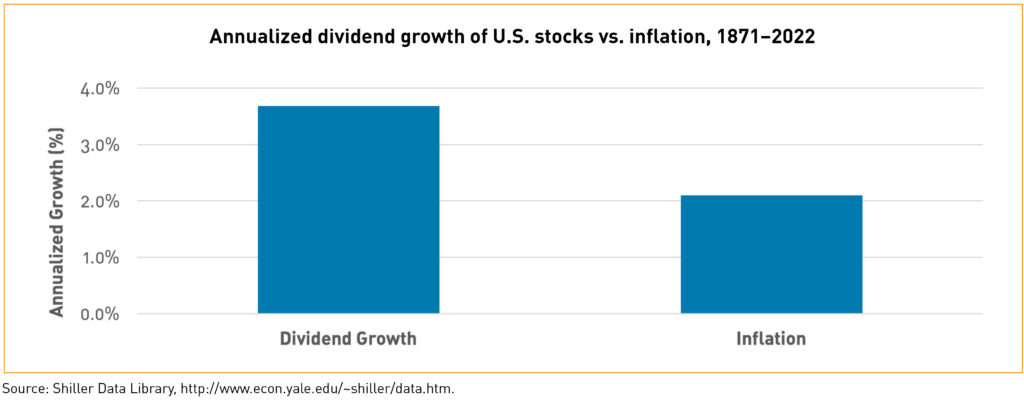

Growing dividends offer a key advantage that many fixed income products cannot – inflation protection. Over the last 150 years, dividends paid by U.S. companies have grown 3.7% per year compared to inflation’s growth at 2.1% per year, demonstrating the enhanced long-term purchasing power dividends provide.

Bahl & Gaynor’s dividend growth philosophy is to own companies with clear competitive advantages and the financial flexibility to navigate uncertain times. Committing to increase a dividend is a strong sign of management’s confidence in the prospects for continued earnings and cashflow growth of the business. Bahl & Gaynor believes owning high-quality, dividend paying stocks is a great strategy for the current inflationary environment.

While the market continues to face several headwinds and the path forward in the near-term is unpredictable, our dividend growth philosophy works to support our clients’ lifestyle needs without the invasion of principal. Pull backs in markets can be healthy and give investors a great opportunity to add to positions when appropriate. Current valuations should be welcomed by those who are able to reinvest their dividends or put new money to work at much lower starting valuations.

We at Bahl & Gaynor remain committed to our mission to deliver exceptional investment advice and service to our clients. Please reach out to your portfolio manager if we can answer any questions; we endeavor always to meet and exceed your expectations.

1 https://www.cnbc.com/2022/06/08/mortgage-demand-falls-to-the-lowest-level-in-22-years.html