Our Approach

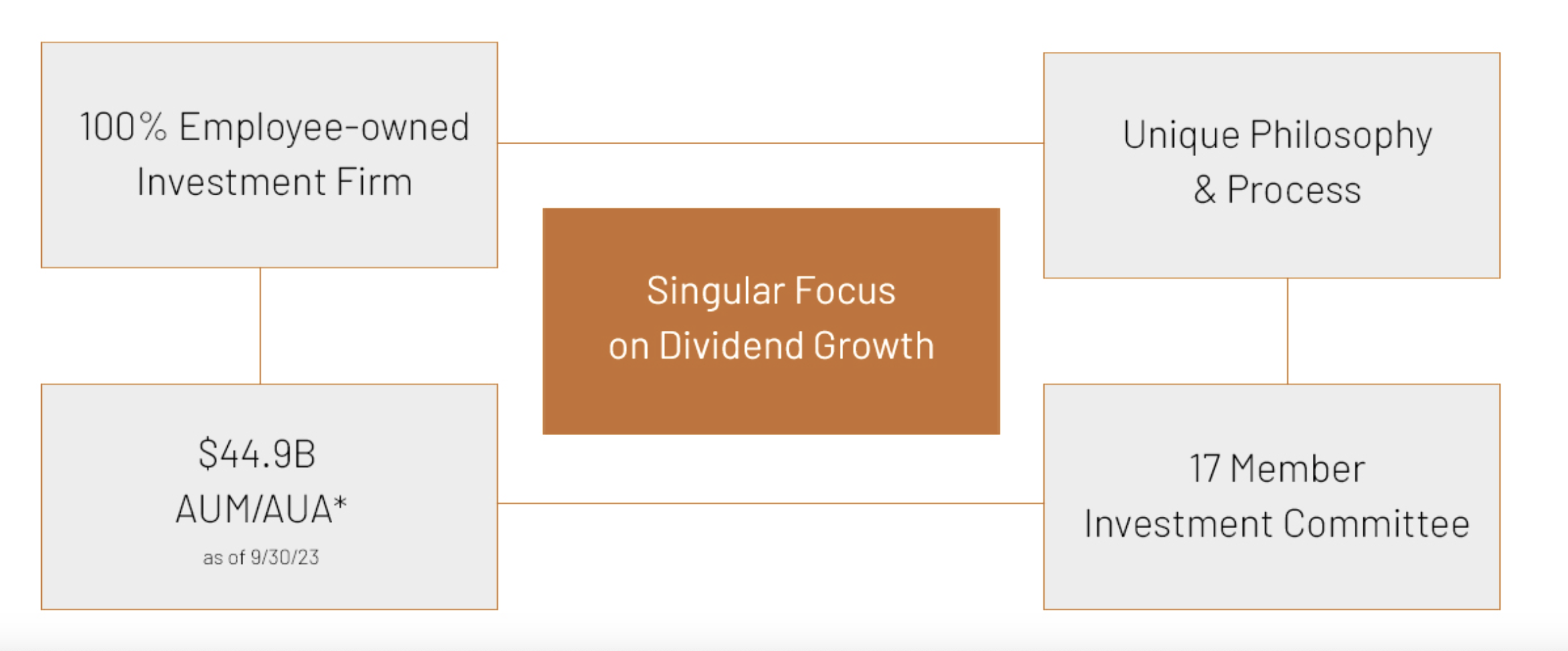

Since 1990, Bahl & Gaynor has pursued a unified fundamental investment philosophy predicated on long-term ownership of high-quality businesses that we believe are uniquely capable of compounding capital and dividends at attractive growth rates.

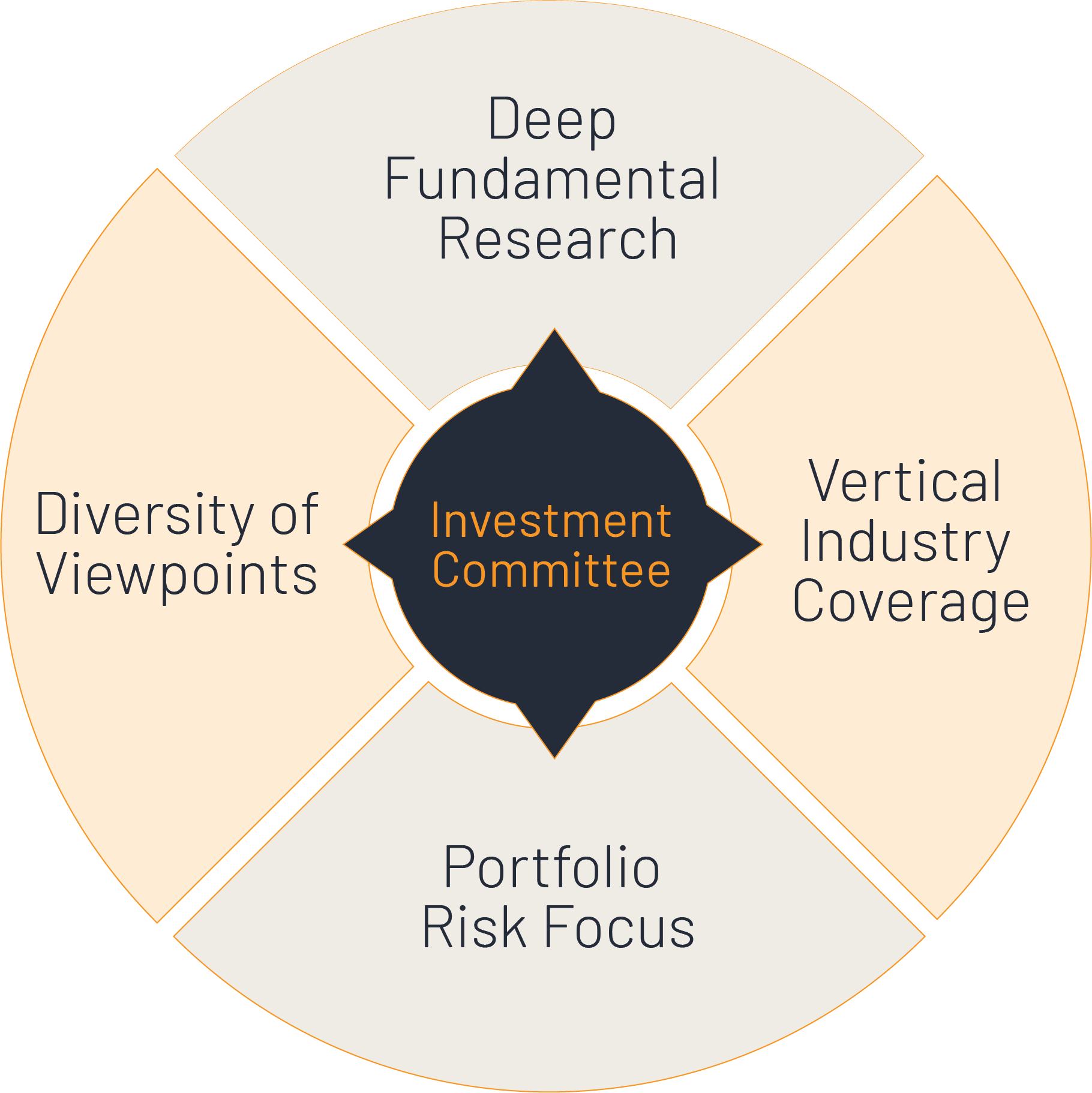

Our Process

Thought Leadership

Capping Risk Redux: The Value of Dividend Growth Investing in a Growth-Dominated Landscape

Learn More

4Q2023 Investor Letter

The Pavlovian market response to dramatically lower interest rate expectations highlights associated risk in broader…

Learn More

Capping Risk: The Value of Dividend Growth in a Cap-dominated Landscape

Executive Summary Recent Equity Market Narrowness It is well understood that recent market performance has…

Learn MoreOur Strategies

Income Growth

Seeking attractive current and growing income with downside risk protection and strong risk-adjusted returns.

Large Cap Quality Growth

Seeking accelerated income growth characteristics.

smig® – Small/Mid Cap Income Growth

Applying our core income growth philosophy to small and midcap companies.

Small Cap Quality Growth

Seeking attractive risk- adjusted return opportunities in small dividend-paying companies.

Our Team

Our intense depth of knowledge regarding equity income growth and downside protection as drivers of risk-adjusted return sets us apart in our industry.

Schedule a Meeting

Subscribe to our newsletter to get to know us, or connect directly with one of our experienced advisors below to learn how our capabilities can help you achieve your goals.