Financial Planning

The Importance of Downside Protection

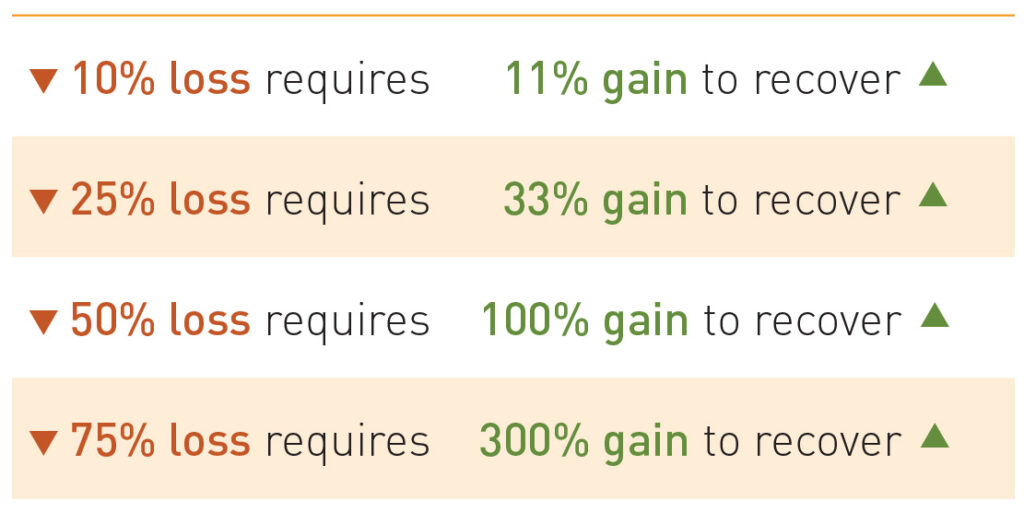

Fact: A 50% portfolio loss requires a 100% return to recover.

Every investor wants strong returns with little or no risk. It’s easy to focus on the strong returns portion of this truth as the S&P 500 reaches a string of record highs. The wise investor, however, considers downside protection strategies when constructing a portfolio. These strategies, used by investment managers, can hedge the losses that may occur with substantial market declines. That’s because big losses require even bigger recoveries in order to return to the break-even point.

Here’s the Math:

Why you may ask? Because calculating the percentages requires using the starting value as the base. Say, for example, a $100 investment loses 10% of its value. Now it’s worth $90. To recoup that $10; take 10, divide by 90, and you’ll need an 11.1% gain to recover the loss. The message is clear: control your losses.

“Predicting rain doesn’t count. Building arks does.” – Warren Buffett

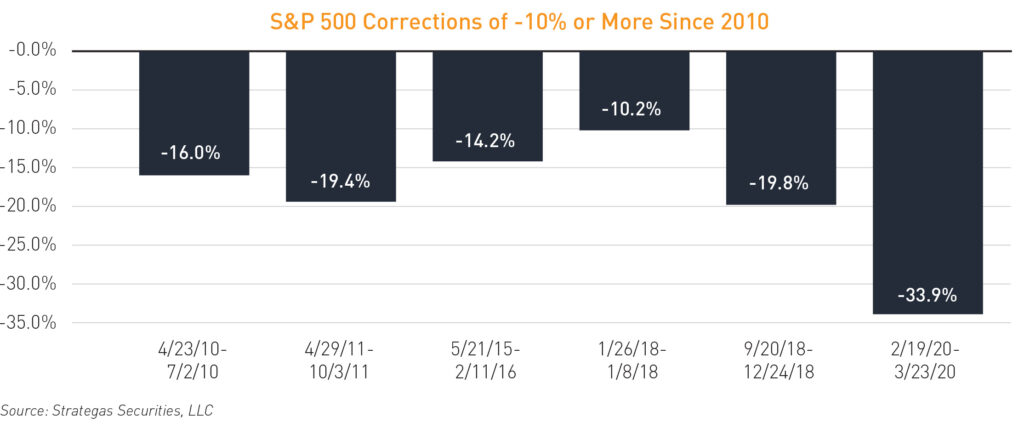

Downturns are inevitable. No one could have predicted the market events of 2020, and while a pandemic is certainly rare, history is rife with declines caused by panic over wars and recessions preceded by burst bubbles, banking, and housing crises… the reasons vary. Pullbacks usually fall within the 5-10% range, but as you’ll see below, declines of between 10 and 20% are not uncommon. In fact, there have been six corrections of more than 10% just since 2010.

So, it’s likely there will come a time when, for whatever reason, your principal shrinks. We want to remind you however, your timeline doesn’t change. Depending on your age, your needs or those of your family, you don’t always have the time it takes to recover from a substantial loss; yet another reason to seek advice on how to protect against unavoidable drawdowns.

Similar to an insurance policy, downside protection strategies provide an additional safeguard investors may not need… until they do. With no strategy in place, investors leave their portfolios subject to unexpected and potentially catastrophic losses.

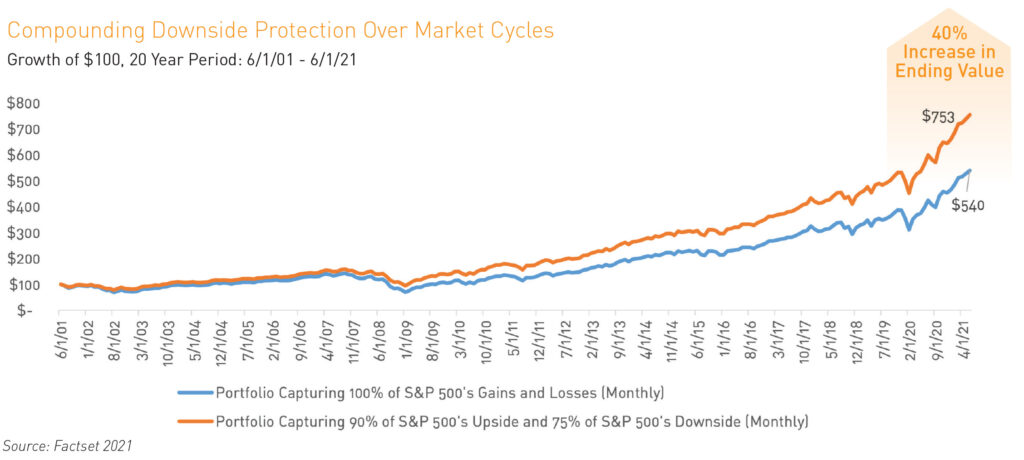

For more than a decade before the global pandemic hit, many investors sailed through an equity bull run, capturing the market’s upside through passive funds. While strategies tracking the markets are able to rise during recoveries, over time, minimizing drawdowns can have a bigger effect on longer-term returns than capturing 100% of the market gains and losses.

The graph below provides an example: The blue line represents a portfolio participating in 100% of the gains and losses of the S&P 500 Index. The orange line shows a portfolio capturing only 90% of the index’s gains and 75% of its losses. Over the last twenty years, investing in this portfolio would have better positioned investors to reach their long-term goals. Add a big market correction to the scenario, and the differences could be even more extreme.

The key here: if your portfolio needs to recover from a loss, it’s not compounding wealth. The uncertainty created by a global pandemic confirmed, during times of crisis the market focuses on specific company attributes; less economic sensitivity, low beta, growth orientation, solid balance sheets, and high return on invested capital (ROIC). An active manager who focuses on fundamentals and research, who remains consistent in his or her strategy while repeating a process that protects capital on the downside, may ease drawdowns over time. The COVID-19 correction is the fifth major decline (greater than 25%) in the Russell 2000 Index since 2008. We believe an advisor with a consistent downside strategy is more valuable now than ever.

Protecting Capital at Bahl & Gaynor

Our long-term dividend growth philosophy is designed to help protect capital through turbulent markets. Dividends account for a significant portion of a stock’s total return. We believe a strong dividend policy signals earnings power, earnings quality, business stability, and financial strength. When stock prices are falling, dividends can provide the cushion that is important to risk-averse investors. In addition, dividend growth is a well-accepted hedge against inflation. If you are nearing retirement, you don’t want inflation to impact your purchasing power.

You’ve worked hard to save for your future. We believe the best way to protect your wealth is to build a portfolio that fits your goals and includes stocks with long track records of paying and increasing dividends. The more reliable that income stream, the less you need to focus on those inevitable market fluctuations impacting your principal value. Dividend paying stocks offer predictable payments and tax advantages, not to mention the peace of mind we believe comes when investing with downside protection in mind.

To learn more about protecting your capital with Bahl & Gaynor you may reach us at info@bahl-gaynor.com or by calling 513-287-6100.

Kelsey Flannery

Portfolio Analyst

Past performance does not guarantee future results. All results are hypothetical and the results are not based on the performance of an actual portfolio and the interpretation of the results should take into consideration of the limitation inherent in the results of the model. The results exclude any advisory fees, trading cost or other fees or charges. The reinvestment of dividends, interest capital gains and withholding taxes are all built into the hypothetical analysis. Hypothetical returns may be dependent on the market and economic conditions that existed during the period. Future market or economic conditions can adversely affect the performance of the hypothetical analysis. The index and other amounts shown above do not relate to the Bahl & Gaynor and are for illustrative purposes only.

The “S&P 500” is a product of S&P Dow Jones Indices LLC (“SPDJI”) and has been licensed for use by Bahl & Gaynor. Standard & Poor’s® and S&P® are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); and these trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by Bahl & Gaynor. Bahl & Gaynor is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates and none of such parties make any representation regarding the advisability of investing in such product nor do they have any liability for any errors, omissions, or interruptions of the S&P 500.

Investment advisory services provided through Bahl & Gaynor Investment Counsel (“B&G”), a federally registered investment adviser under the Investment Advisers Act of 1940. Registration does not imply Information or a certain level of skill or training. More information about B&G can be found by visiting www.adviserinfo.sec.gov and searching by the adviser’s name. This is prepared for informational purposes only and may not be applicable to your particular situation or need(s). It does not address specific investment objectives. Information in these materials is from sources B&G deems reliable, however we do not attest to their accuracy. Past performance is not indicative of future results. Indices and benchmarks are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment. Index return information is provided by vendors and although deemed reliable, is not guaranteed by B&G. No fiduciary relationship exists because of this commentary. If you have any questions regarding the indices or investments referenced in this presentation, contact your B&G investment professional.