Quarterly Review

The Fed Means Business.

Have Investors Caught On?

Detailed Review

Detailed Review

At Bahl & Gaynor we have been struck by the yo-yo pattern of equity markets throughout the course of 2022. The playbook behind these volatile bouts across asset classes has largely remained the same: collective market hubris looking beyond current economic headwinds only to humbly be reminded that central bank policy and sticky inflation are powerful forces that drive long-term financial conditions. September was a painful month with the S&P 500 at year-to-date lows, but the Fed’s hawkish rhetoric this quarter may have convinced the market that the path to price stability will be a prolonged, bumpy ride.

While stubborn inflation and higher interest rates remain front and center, several other topics and subsequent derivative effects remain top of mind at Bahl & Gaynor:

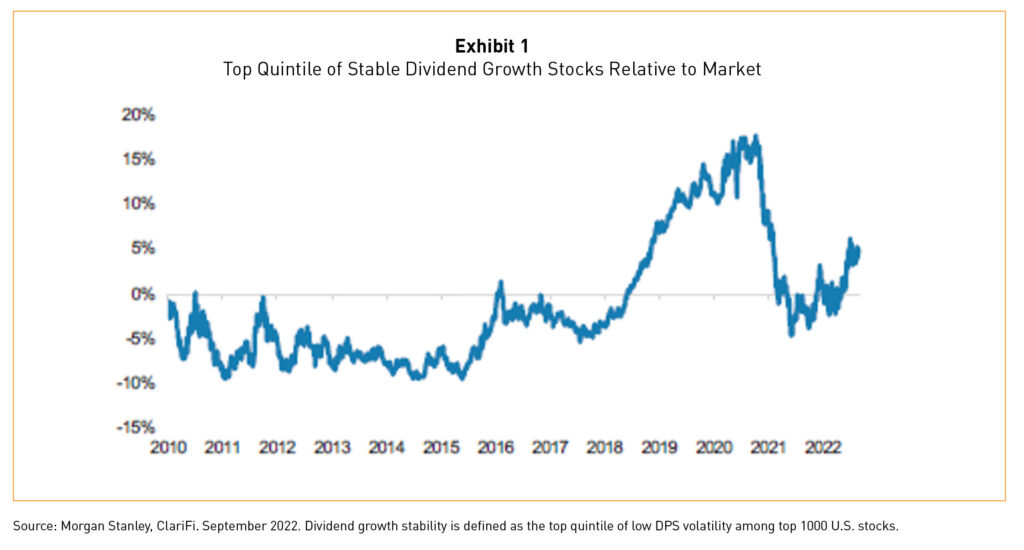

Quantitative Tightening

Between 2020 and 2021, the Fed injected a massive amount of stimulus into the U.S. economy through its Quantitative Easing program by purchasing U.S. Treasuries and mortgage-backed securities to more than double the size of its total balance sheet. Combined with a close to zero-interest rate policy, this monetary phenomenon resulted in excess risk-taking with investors jumping into speculative securities such as cryptocurrencies and meme stocks. It’s easy to see how this risk-taking in speculative corners of the market left higher quality, dividend-growth securities disproportionately disadvantaged (Exhibit 1). To the extent the Fed remains on track to reverse this unprecedented level of support to markets, we’d expect factors such as quality and dividend growth to remain ballasts for client portfolios as they have been during 2022.

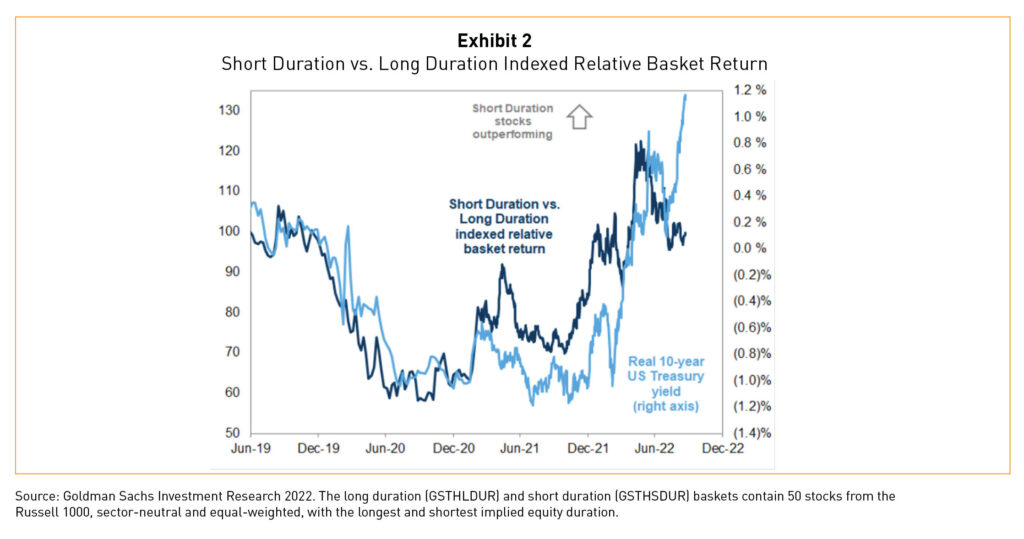

Real Interest Rates

A continued hawkish Fed throughout 2022 has driven real 10-year U.S. Treasury yields out of negative territory to aproximately 1.3%, the highest levels since 2011. Real yields measure the compensation U.S. Treasury investors receive after accounting for expected inflation. Higher real yields make investments with near-term cash flows, such as dividend and dividend growth securities, relatively more attractive than high-growth and long-duration equity securities (Exhibit 2) as further-out cash flows become less valuable in today’s dollars.

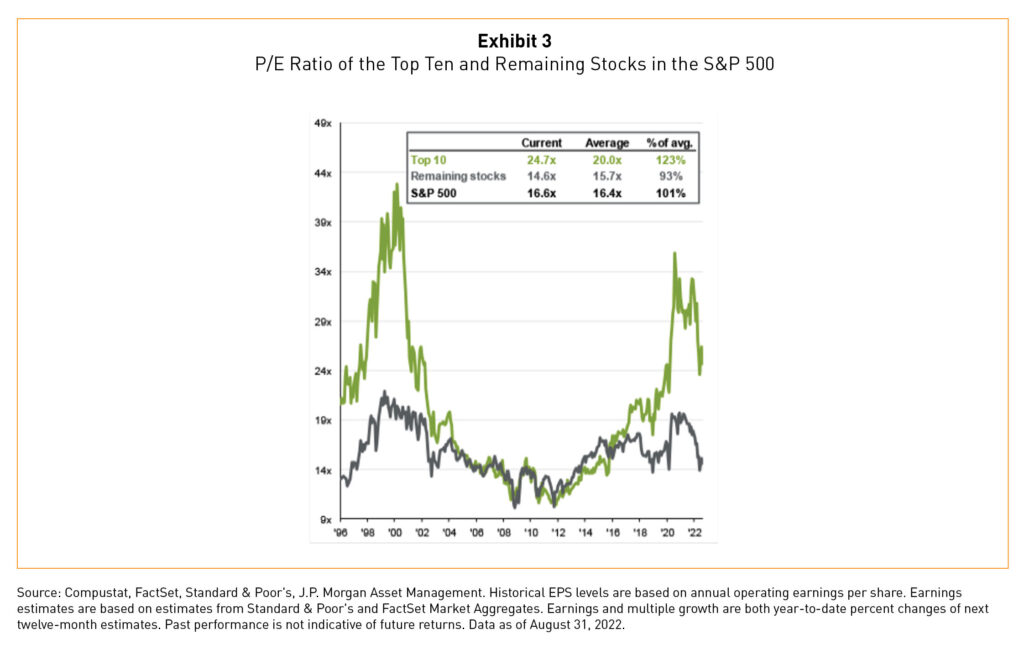

A Top-Heavy S&P 500

The S&P 500’s top ten constituents continue to carry a valuation premium versus the rest of the index, indicating room for valuation compression for this cohort of securities (Exhibit 3) especially since the cohort’s earnings contribution to the index has fallen nearly 40% from its peak in 2021, according to J.P. Morgan Asset Management. As many active managers, including Bahl & Gaynor, continue to be significantly underweight the largest market-cap weighted stocks, a valuation covergence to the rest of the index would be a relative performance tailwind.

Bringing Complexities into a Solution: Dividends and Dividend Growth

Amidst this complex, ever-changing, tug-of-war backdrop markets will likely remain choppy, making it, in our view, the best time to own equities that have sustained earnings power and business stability through an economic cycle. Coupled with strong shareholder governance and dividend policy, a portfolio of these high-quality stocks can have a beta, or market sensitivity, well below one. A portfolio of this sort may result in a less volatile investor experience.

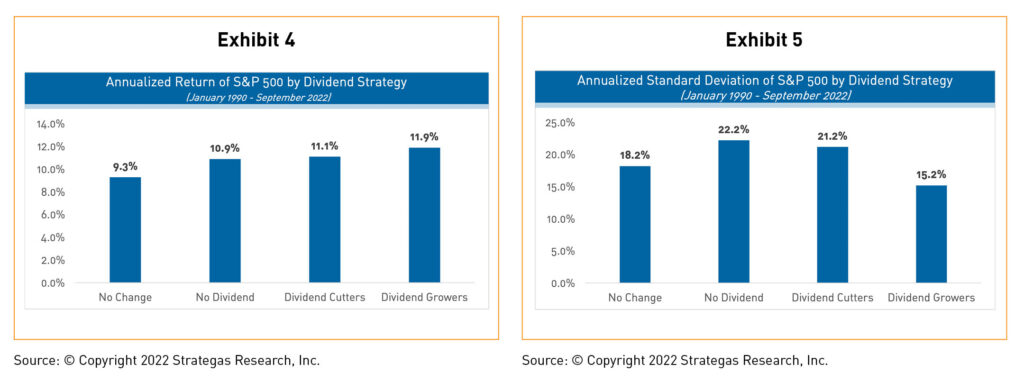

If the overall direction of the market continues to be down, dividend payers and growers often protect on the downside given the high-quality nature of their businesses. Year-to-date, dividend payers have exhibited these characteristics, outperforming non-payers given their “safety qualities” in a broadly risk-off market, or simply put – winning by losing less. In the long run, companies with growing dividends also tend to outperform, with lower volatility, resulting in better risk-adjusted performance (Exhibits 4 and 5).

Closing Thoughts

It is Bahl & Gaynor’s responsibility to imagine a variety of potential market outcomes. We continue to believe our high-quality, dividend strategies are positioned to provide positive dividend growth alpha for investors. Our strategies remain fully invested and will participate when equity markets ultimately recover.

As always, we at Bahl & Gaynor remain committed to our mission to deliver exceptional service to our clients. We seek to provide a high-quality investment strategy characterized by a growing stream of income, a component that remains especially relevant in today’s difficult environment.