Market Update

Tax Hike History and Stock Market Moves

April 23, 2021

This line lives in the fine print at the bottom, but perhaps we should also state it up front: “Past performance is no guarantee of future results.” Still, let’s look back on how the raising of capital gains taxes has impacted the stock market in the past. Your assumptions about the future may be wrong.

This review is prompted by the news, according to Bloomberg, President Biden is considering a capital gains tax for the wealthy as high as 43.4% (including a surcharge).1 By wealthy we mean individuals who earn more than $1M.

We do know, historically, big tax increases are rare. Most recently tax rates were cut through the Tax Cuts and Jobs Act passed in 2018. Under current law, the top marginal capital gains rate is 20%.

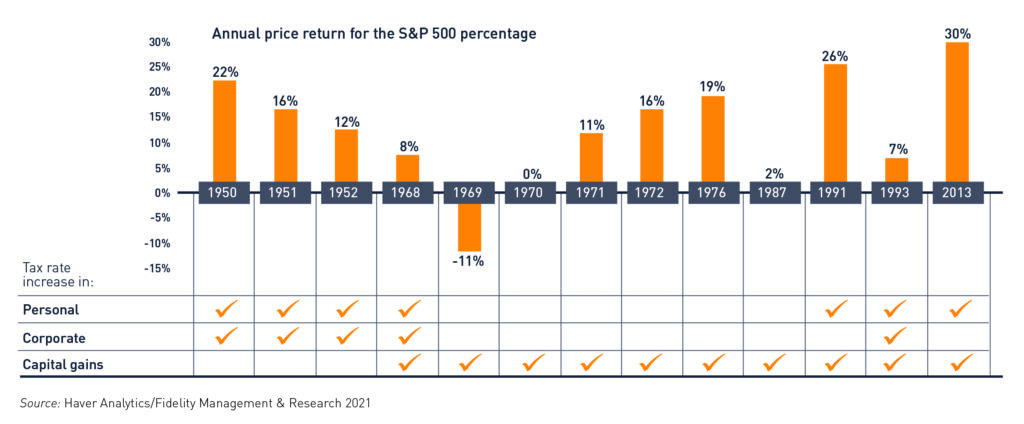

Since 1950, there have been ten years of notable capital gains increases. When compared with the S&P 500, we find positive returns in eight of those ten years. Stocks fared even better during those years when personal and corporate taxes rose, see below.

Why? There are several factors to consider; stocks likely priced in the increases and there was often significant stimulus spending by the government. The most important condition, and one that is also evident now, is a strong economy. Leaders in Washington typically only increase taxes when the economy is strong enough to withstand it, and that condition generally is accompanied by positive equity returns. (Important note: tax Increases need to be modest in order to not overwhelm a sound economy.)

Here is where the aforementioned warning about past performance and guarantees applies; there is no previous economic environment quite like the one created last year with a global pandemic, recession, and volatile, recovering market. Adding tax burdens to the mix may seem an ominous move. Still, we can’t assume tax increases necessarily mean down markets. In fact, given historical data, the opposite appears more likely.

Another truth: in any market, under any tax plan, your needs are unique to you. At Bahl & Gaynor we address our clients’ individual goals with customized plans devoted to our dividend growth philosophy, one that for the last three decades has endeavored to meet and exceed expectations.

Samuel L. Koopman, CFP

Portfolio Manager and Principal

This commentary is for informational, education, and research purposes only. No fiduciary relationship exists because of this commentary. Past performance is not necessarily indictive of future results. Investing in securities involves risk of loss that the client should be prepared to bear.