For Your Information

Quality Counts

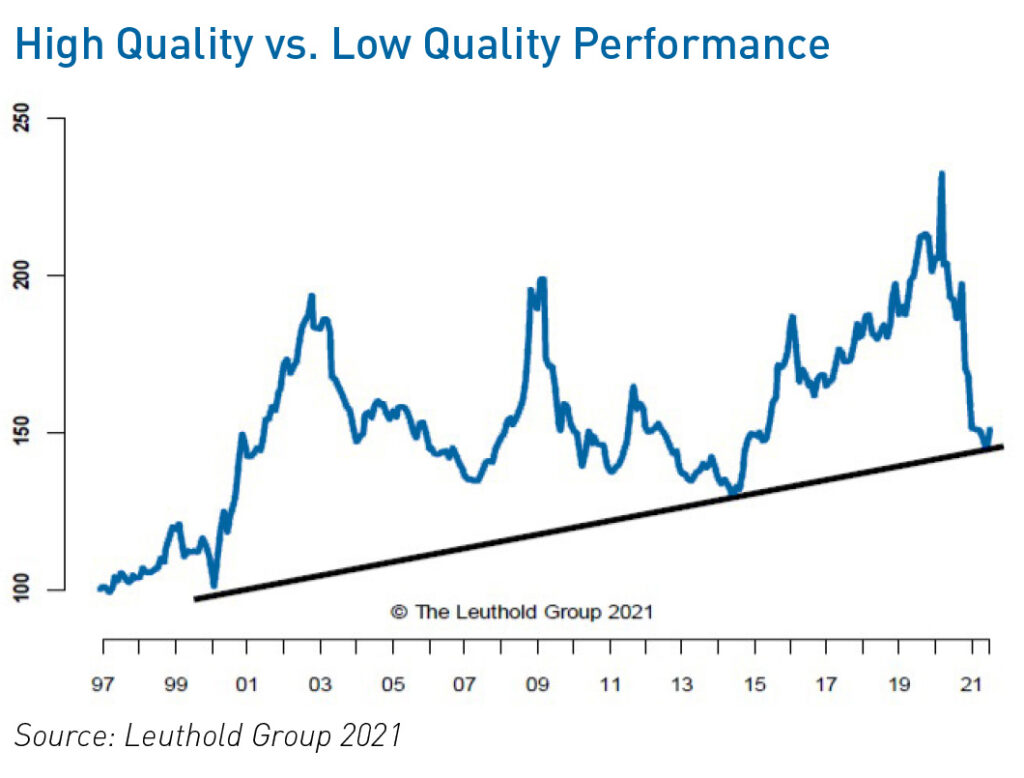

The post-COVID value rally at times… okay, often… ignored a tenet of long-term investing: quality. The rampaging bull market which featured the bidding of cheap stocks may have, as the following chart shows, run its course.

Here we see the early, but material signs of an upturn in quality performance in the last few months. When the blue line is moving up, the stock prices of high-quality companies are outperforming those of low-quality companies. When the line is moving down, low quality is outperforming high quality. The black trend line indicates the place where, historically, an investor preference for low quality stocks reverses and quality comes back in favor. As you can see, this reversal typically lasts several years. Leuthold Group researchers point out in a recent report1, there is room to grow right now and the upside for quality is huge.

Throughout our more than 30-year history, Bahl & Gaynor prioritized quality through long-term ownership of dividend growth stocks. Investors who favor quality stocks that trade at a reasonable price should also note what is seen in the following chart: the stability of dividend payouts over the last five years, even last year, during one of the most severe recessions in history.

In the first seven months of this year, among the 20 largest U.S. dividend payers, 11 increased payouts, nine remained unchanged, and not one decreased its dividend.2

This encouraging news supports what we at Bahl & Gaynor believe: quality counts. Quality performance and dividend stability are no surprise to our investment professionals who believe it to be especially important during market drawdowns.

There is no doubt, times remain precarious as many people find themselves dusting off their masks to enter public spaces. Still, rising delta variant COVID cases have not translated into rising jobless claims. In fact, claims have been down now for four straight weeks.3 The strengthening labor market is a real positive for economic growth. Perhaps more indicative: gross domestic product growth caught up to and exceeded the inflation adjusted GDP level of the last three months of 2019, preceding the pandemic.4 Some supply chain bottlenecks are beginning to ease, indicating a rise in consumer spending, particularly as we enter the holiday season.

So, we believe the economy remains on a track toward normalization and an important ingredient for the return to market reality is quality performance. Bahl & Gaynor typically invests in high-quality companies that pay growing dividends. We believe a strong dividend policy signals earnings power, earnings quality, business stability, and financial strength. Our goal: to build for each client, a customized income stream for retirement, education, recreation… while protecting your principal investments, even during volatile markets.

Edward A. Woods, CFA, CIC

Portfolio Manager

1 https://bit.ly/3kjyCMt

2 https://bit.ly/2XRkKl7

3 https://on.wsj.com/3DnpMGv

4 https://bit.ly/3sy0ss6

Investment advisory services provided through Bahl & Gaynor Investment Counsel (“B&G”), a federally registered investment adviser under the Investment Advisers Act of 1940. Registration does not imply Information or a certain level of skill or training. More information about B&G can be found by visiting www.adviserinfo.sec.gov and searching by the adviser’s name. This is prepared for informational purposes only and may not be applicable to your particular situation or need(s). It does not address specific investment objectives. Information in these materials is from sources B&G deems reliable, however we do not attest to their accuracy. Past performance is not indicative of future results. Indices and benchmarks are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment. Index return information is provided by vendors and although deemed reliable, is not guaranteed by B&G. No fiduciary relationship exists because of this commentary. If you have any questions regarding the indices or investments referenced in this presentation, contact your B&G investment professional.