Quarterly Review

Momentum is a Powerful Thing

Detailed Review

Detailed Review

So too are compounding dividends

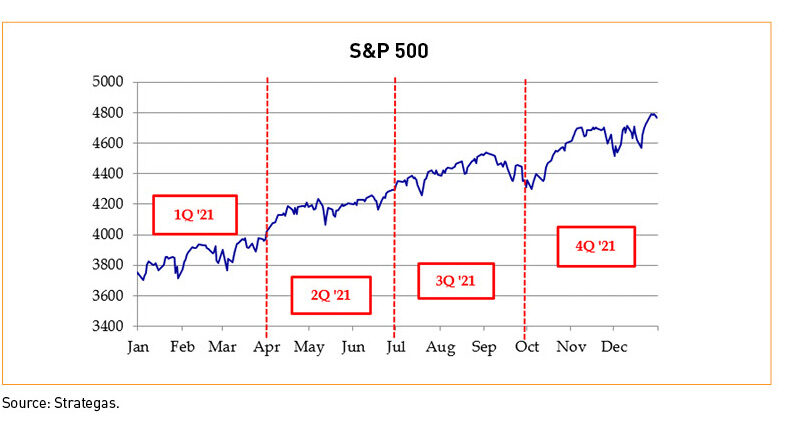

As the US economy continues to recover from the 2020 COVID-induced lockdowns, the major stock market averages posted another year of strong returns in 2021.

Equity markets were buoyed by continued policy support from the Fed and from pent-up consumer and business demand that drove strong company earnings across all sectors of the market. We begin 2022 acknowledging last year’s high points yet remain mindful of the continued unpredictability of COVID-19 coupled with the challenges of inflationary pressures and elevated stock valuations.

Of important note, the top ten companies in the S&P 500 comprised 30.5% of the market capitalization of the index as of December 31, 2021, the highest percentage in more than 30 years.

While it is impossible to predict market direction, there are indications the market cycle is maturing some 22 months off the March 2020 lows. This suggests forward market returns may be more muted. When the tide recedes, where will the market land? We believe an investment in an equity portfolio that provides consistent, growing income from high-quality companies remains a very wise investment strategy.

COVID, Supply Chains, and Inflation

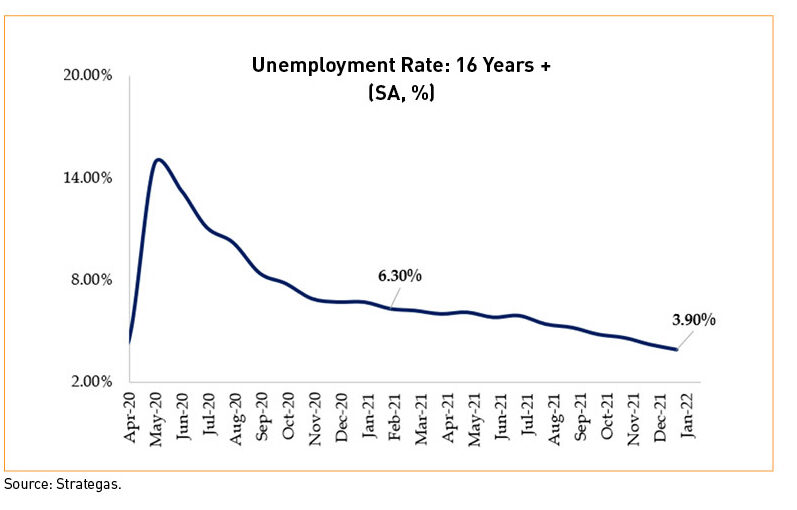

2021 was not the “back to normal” we all sought, but we have made progress. This time last year the country awaited widespread distribution of effective vaccines and unemployment remained elevated, at 6.3% versus December 2021 levels of 3.9%.

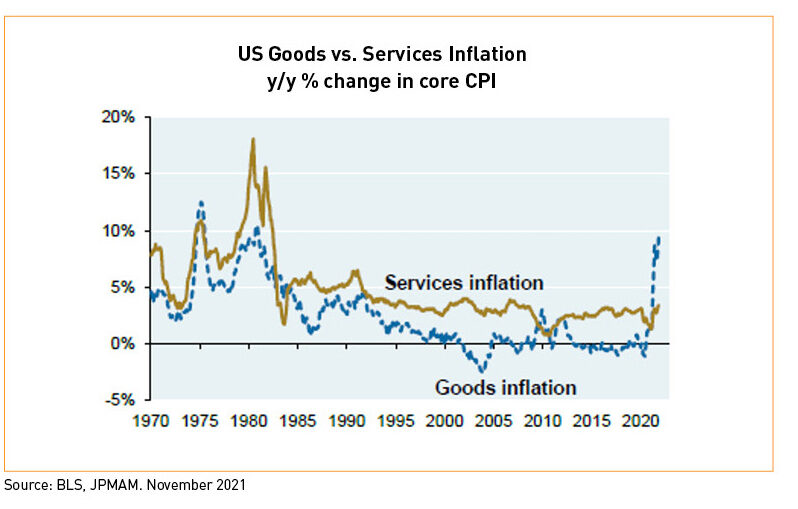

Arguably, a significant risk to the economy in 2022 is renewed COVID lockdown measures, though it appears there is little appetite for them. Lockdowns changed consumer spending habits driving a surge in spending for goods versus services, which initially started the strained supply chain problem and associated inflation. In the U.S. and Europe, there are initial signs that a shift back to services is occurring which may alleviate goods-related supply chain issues and the price of goods.

Still, labor shortages may persist and drive higher wages for those who continue to work. The latest data from the Bureau of Labor Statistics shows year-over-year private sector wage growth at 4.7%. With the tightest labor markets in three to four decades, as indicated by rising job openings and voluntary quits, the impact this will have on wages and how the Fed will respond is uncertain.

Federal Reserve Actions

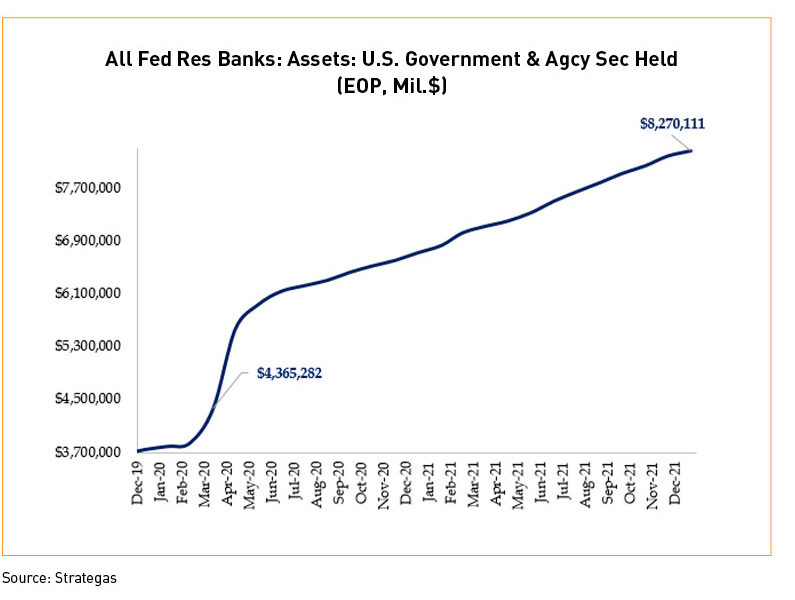

Recent stock market strength has been driven in part by quantitative easing initiated by the Fed through its bond-buying program designed to prop up the economy during the pandemic. Surging inflation, a growing U.S. economy and improving labor market have forced the Fed to taper, or slow, its purchases, thus removing stimulus to economic growth that may be fueling inflation. The Fed chair retired the word “transitory” in the fourth quarter and admitted, “Factors pushing inflation upward will linger well into next year.” Inflation currently stands at 7% and is a significant concern to consumers and businesses.

The Fed has signaled a move to increase short-term interest rates several times in 2022, starting as early as March, and may even begin to reduce the size of its large balance sheet of nearly $8.3 trillion.

What happens to the markets post taper? If the short-lived “taper tantrum” of 2013 is any indication, not much. There was a small pullback that lasted little more than a month and the year ended with the S&P rising 32%, one of the best years on record. Given the unpredictability of near-term market events, we advise our clients against timing the market to try to avoid short-term setbacks at the expense of longer-term gains.

Fed policy may also be impacted by results of mid-year elections. Persistent inflation threatens Democratic control of Congress. Consumer confidence is wavering1 and the mood of the electorate could impact results at the polls, further influencing the future of the Build Back Better plan. The President’s Build Back Better plan was rejected in the last days of 2021 on fear from both sides of the aisle that the roughly $2T social and climate spending package would further fuel inflation. While the path forward remains in question, the delay will likely benefit corporate and individual taxpayers as tax increases proposed to fund the plan are delayed. Potential tax increases were a concern to individuals and businesses, any deferral may provide a boost to the markets.

The Enduring Relevance of Dividends

Strong earnings in 2021 enabled many companies to allocate more capital to stock buybacks and dividends. The strong cash flow positions that allow businesses to invest in themselves and return cash to shareholders are expected to continue in 2022.2

Since 1936, dividends have contributed 37% of the S&P 500’s total return3. For more than 31 years, Bahl & Gaynor has been dedicated to a philosophy that seeks to invest in high quality businesses with growing dividends. An investment strategy predicated on providing consistent and growing income should provide investors with real purchasing power growth and reduced vulnerability to market volatility through downside protection.

Our wish in the New Year is that scientific advancements offer protection, treatment, and hope so that COVID’s impact on our economy is tempered and we begin to heal in every aspect of our lives. We greet 2022 with renewed vigor knowing this: “There is no medicine like hope, no incentive so great, and no tonic so powerful as expectation of something better tomorrow.” – Orison Swett Marden

1 https://fred.stlouisfed.org/series/UMCSENT

2 https://www.wsj.com/articles/companies-plan-to-pour-even-more-cash-into-buybacks-dividends-in-2022-11640169002?mod=Searchresults_pos2&page=1

3 Ned Davis Research, Inc. (prior to 9/30/2018), FactSet (post 9/30/2018).

Investment advisory services provided through Bahl & Gaynor Investment Counsel (“B&G”), a federally registered investment adviser under the Investment Advisers Act of 1940. Registration does not imply Information or a certain level of skill or training. More information about B&G can be found by visiting www.adviserinfo.sec.gov and searching by the adviser’s name. This is prepared for informational purposes only and may not be applicable to your particular situation or need(s). It does not address specific investment objectives. Information in these materials are from sources B&G deems reliable, however we do not attest to their accuracy. Past performance is not indicative of future results. Indices and benchmarks are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment. Index return information is provided by vendors and although deemed reliable, is not guaranteed by B&G. No fiduciary relationship exists because of this commentary. If you have any questions regarding the indices or investments referenced in this presentation, contact your B&G investment professional.