Financial Planning

Markets (Babies) Can Remain Irrational (Crying) Longer Than You Can Remain Solvent (Calm)

By Kevin Gade, CFA, CFP

Chief Operating Officer & Portfolio Manager

My wife and I were blessed with our first child in early July. First time parenting is a sight for those who have been through it before, especially when you combine two Type-A personalities. Precisely scheduled feedings and naps as prescribed by veteran “baby experts” have been adopted. And while I give my wife full credit for her adaptability for when our daughter goes “off-script,” these first few weeks have been a crash course in patience as a new father.

Two things quickly learned were:

- Time under pressure feels much longer than it actually is.

- Patience pays off.

When our daughter needs to be put down for the night, calm leaves the room. Her tears are made to break grown men. Right when I question my mental endurance against the will of an eight-week-old I observe her settling in my arms. Patience in that moment prevailed.

As new parents, we have a heightened respect for all parents and caretakers and a deeper understanding of composure and patience. We are beginning to understand moments are just moments. It’s the decisions in the moment that help define our lives.

Investing with Patience and a Time-Tested Plan Built Alongside Your Investment Adviser

The past few years have felt like a lifetime of ‘one-time’ events for investors, including:

- The paralysis & fear of a global pandemic that impacted our health, the economy, and markets,

- Massive consumer & economic stimulus (ex. COVID stimulus checks to individuals and businesses) that drove risky assets to levels not seen since the 2000 dot-com bubble,

- The fastest Federal Reserve interest rate hiking campaign since 1989 aimed to combat US inflation which hit both stocks and bonds hard last year, and;

- A confusing year-to-date 2023 market experience focused on artificial intelligence (AI) and a stronger-than expected US economy driving equity markets higher, albeit in a very narrow fashion lead by a few, high-growth and very expensive companies.

Undoubtedly, there have been moments when you may have wondered if your investment and financial plan needed a refresh. Whether your friends were talking about the latest money-printing investment over an awkward 2020 Zoom Happy Hour or maybe the global market correction of 2022 made you pause to even look at your account balances, the behavioral side of sticking to your well-laid plans came under pressure. Like the lessons learned as a first-time parent, often the best course of action has been to maintain composure, stay patient and trust the resilience of your personalized financial plan, especially if the gameplan was crafted alongside your trusted investment advisor, like Bahl & Gaynor.

Expectations versus Reality

Periods of bliss and pain are known to trigger the emotional side of us at the expense of rationality, especially when it comes to money. Humans tend to buy investments when prices are high to join everyone else (herd mentality) only to sell when prices have suddenly fallen for fear of losing even more money (loss aversion). These behavioral impulses have proven to negatively impact the average investor significantly over time.

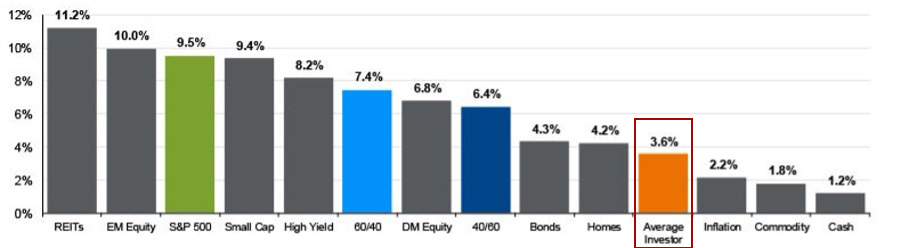

Seen in the chart below, the average investor has underperformed both the broad US market and the 60%/40% stocks/bond portfolio by nearly 6% and 4%, respectively, for the 20-year period through the end of 2021. In dollar terms, the average investor that started with $100,000 in initial investment would end with $412,000 less than if they had simply invested in the S&P 500 over the same 20-year time period ($203,000 versus $614,000, respectively). Lack of patience and irrational decision-making during very good times and very difficult times can truly have a painful effect on one’s wealth if not managed well.

20-year annualized returns by asset class (2002-2021)

Source: Bloomberg. FascSet, Standard & Poor’s. JP Morgan Asset Management on the chart: “Indexes used are as follows: REITS: NAREIT Equity REIT Index, EAFE: MSCI EAFE, Oil: WTI Index, Bonds: Barclays Capital U.S. Aggregate Index, Homes: median sale price of existing single-family homes, Gold: USD/troy oz, Inflation: CPI. Average asset allocation investor return is based on an analysis by Dalbar Inc., which utilizes the net of aggregate mutual fund sales, redemptions and exchanges each month as a measure of investor behavior. Returns are annualized (and total return where applicable) and represent the 20-year period ending 12/31/21 to match Dalbar’s most recent analysis. Guide to the Markets – Data as of 12/31/2021.

“Stay in the Tank” and Experience the Benefits of Staying Invested for the Long-Term

A long-time portfolio manager at Bahl & Gaynor uses the phrase “Stay in the Tank” whenever the stock market becomes volatile. Maintaining composure and sticking to your personalized investment & financial plan during the most difficult market times is supported by the following:

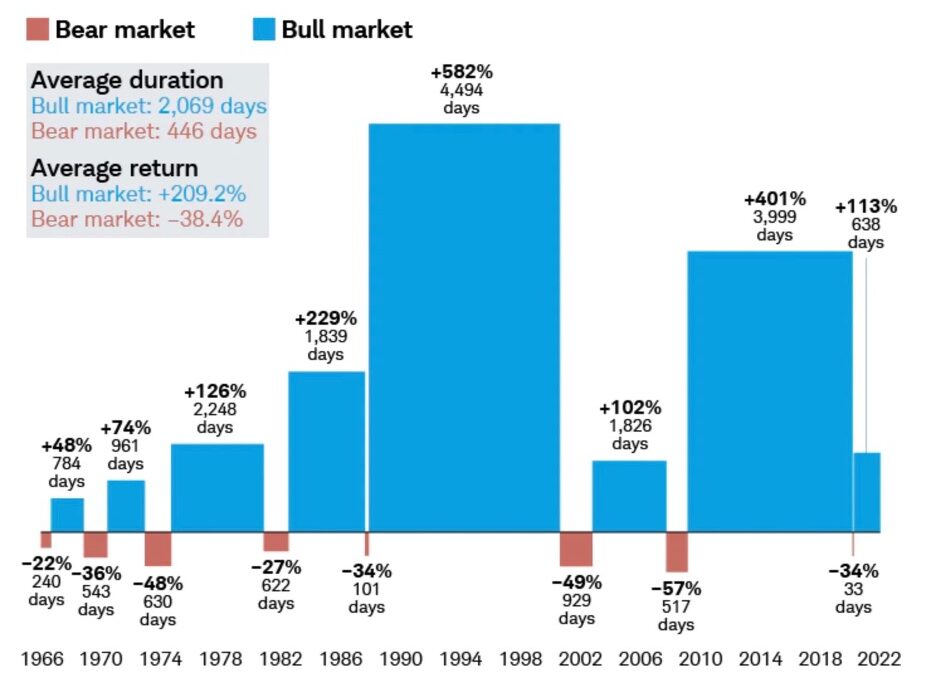

- Since 1966, bear markets in the S&P 500 have lasted much less time at roughly 15 months versus six years for bull markets.

- The S&P 500 has always returned to its previous peak within a couple of years after the end of each bear market.

- The largest daily gains/recoveries tend to occur immediately after bear markets end.

- It is almost impossible to time the market, especially the top and bottom of the market.

- Investing in high-quality dividend growth stocks has rewarded long-term investors willing to invest through short-term market volatility.

The chart below illustrates the powerful message of staying invested even when markets are challenging and TV pundits are screaming “sell, sell, sell.” like a fussy newborn in the evening. Having the fortitude to withstand these moments of volatility starts with the decision to build a personalized financial plan and portfolio before the downswings of the market begin.

So, when market moments get difficult, remember, they are just moments that will pass and are necessary events on the long-term path of wealth creation. The decisions to plan and prepare, not the moments, will help define your life, financially and beyond.

The Benefits of Bull Markets Favor Long-Term Ownership of Stocks

Source: Schwab Center for Financial Research with data provided by Bloomberg as of 12/31/2021.

The market is represented by daily price returns of the S&P 500 index. Bear markets are defined as periods with cumulative declines of at least 20% from the previous peak close. Its duration is measured as the number of days from the previous peak close to the lowest close reached after it has fallen at least 20%, and includes weekends and holidays. Periods between bear markets are designated as bull markets. Indices are unmanaged, do not incur fees or expenses, and cannot be invested in directly. Past performance is no guarantee of future results.

Conclusion

Since 1990, Bahl & Gaynor has helped individuals focus on life’s most important moments and people while we aid in their pursuit of financial freedom. Our long-term relationships have demonstrated confidence through our consistency in building individualized financial plans, investing client capital in our time-tested proprietary strategies, and delivering exceptional service.

We appreciate those individuals that have trusted our firm with deeply personal money matters and look for opportunities to partner with more individuals and institutions in the future.

Investment advisory services provided through Bahl & Gaynor Investment Counsel (“B&G”), a federally registered investment adviser under the Investment Advisers Act of 1940. Registration does not imply Information or a certain level of skill or training. More information about B&G can be found by visiting www.adviserinfo.sec.gov and searching by the adviser’s name. This is prepared for informational purposes only and may not be applicable to your particular situation or need(s). It does not address specific investment objectives. Information in these materials are from sources B&G deems reliable, however we do not attest to their accuracy. Past performance is not indicative of future results. Indices and benchmarks are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment. Index return information is provided by vendors and although deemed reliable, is not guaranteed by B&G. No fiduciary relationship exists because of this commentary. If you have any questions regarding the indices or investments referenced in this presentation, contact your B&G

investment professional.

The “S&P 500” is a product of S&P Dow Jones Indices LLC (“SPDJI”), and has been licensed for use by Bahl & Gaynor. Standard & Poor’s® and S&P® are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); and these trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by Bahl & Gaynor.

Indices are unmanaged, hypothetical portfolios of securities that are often used as a benchmark in evaluating the relative performance of a particular investment. An index should only be compared with a mandate that has a similar investment objective. An index is not available for direct investment and does not reflect any of the costs associated with buying and selling individual securities or management fees.

Charts and Tables are sourced using third-party data. Bahl & Gaynor does not represent the information is accurate or complete and it should not be relied on as such. Bahl & Gaynor assumes no liability for the interpretation or use of this report. For Illustration purposes only. Past performance does not guarantee future results. The index and other amounts shown above do not relate to the Bahl & Gaynor strategies and are for illustrative purposes only.