Quarterly Review

Kick the Football, Charlie Brown!

Detailed Review

Detailed Review

You’ve read it before – the classic Peanuts story where Lucy asks Charlie Brown to kick the football only to pull it away at the last moment, sending gullible ‘ole Charlie Brown flat on his back. In fact, Peanuts author Charles Schulz is credited with publishing the printed strip for 37 years! Every. Single. Time. Charlie Brown gives in to trusting Lucy only to be fooled yet again.

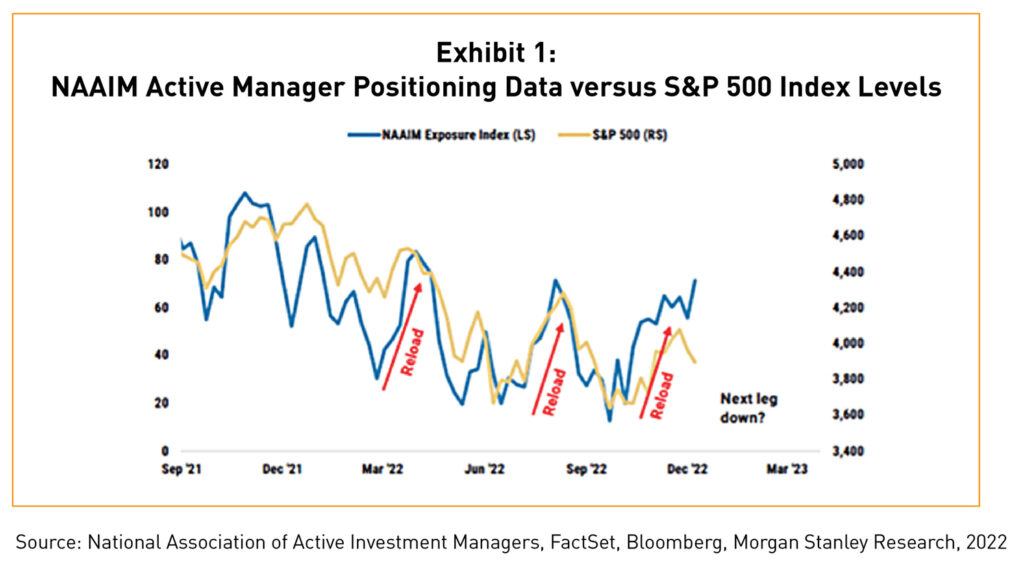

The relationship between the Fed and market participants in 2022 resembled Charlie Brown’s failure to learn his lesson time and time again. Despite repeated commitments by the Fed to tame inflation with restrictive money policy, investors have responded with bullish behavior only to have the Fed squash attempts at these market rebounds *cue the football pull*. Throughout the year, the market has ripped higher into Fed announcements only to give back the gains (and often more) afterwards (Exhibit 1).

At Bahl & Gaynor, we have avoided the pitfalls of this groupthink behavior. As a result, our strategies generated outperformance in 2022 from these “awe then shock” moments due to each strategy’s ability to protect on the downside while participating in market rallies. Just as Mr. Schulz’s readers received comedic relief each year wondering if Charlie Brown learned his lesson, to no avail, Bahl & Gaynor investors better-weathered market volatility due to the firm’s even-tempered approach in this Lucy-like, tricky environment.

‘A’ is for Alpha and Asymmetry

Howard Marks, famed investor and Oaktree founder, recently discussed the idea of delivering performance Alpha, or excess return versus the market, through asymmetry. Simply put, a manager can add value for clients through the following:

1. Manager A: Outperforms the market during positive periods while minimizing underperformance in poor markets enough to preserve value-add.

2. Manager B: Outperforms the market during negative periods while minimizing underperformance in positive markets enough to preserve value-add.

3. Manager C: Outperforming the markets during both good and bad periods (Dare we say our hometown Cincinnati Bengals are starting to display a strong offense and defense!?).

Since our founding, Bahl & Gaynor has sought to invest client capital like Manager B – protect on the downside while participating in market upside. Across all marketed strategies, Bahl & Gaynor has remained committed to its high-quality, dividend-growth discipline. The result: long-term Alpha generation.

Optimism Sprinkled with a Dose of Mean Reversion

Our late co-founder, Bill Bahl, often said, “It takes an optimist to succeed in equity investing.” The firm will forever take these words to heart as we seek to buy and own companies with competitive advantages that provide long-term value to our investors through capital return and risk-adjusted total return.

In the last decade, active managers with a high-quality philosophy faced headwinds to relative performance as muted volatility and low interest rates from the Fed created massive investor risk-taking in speculative corners of the market that pushed indices higher. This headwind abated in 2Q2022 as the Fed began to pull away the punch bowl, allowing active management to again prosper.

As we flip the calendar to January, investors often ask for our market predictions. While Bahl & Gaynor resists temptations to offer an outlook on the short-term, we offer two mean-reverting market trends currently underway that support conviction in our high-quality, dividend growth philosophy.

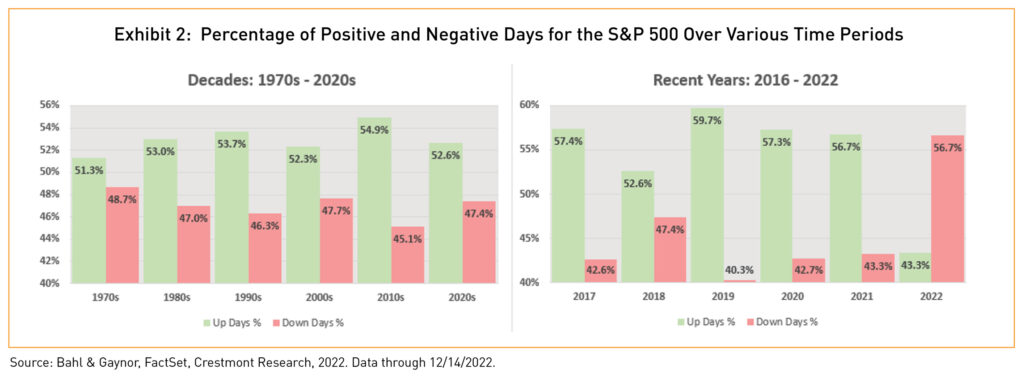

Ratio of Up-to-Down Days

Going back to 1951, 53.5% of S&P 500 days have yielded a positive return while 46.5% resulted in a negative return. Volatility aside (we will cover this below), an active manager with an 82% upside capture ratio (strategy return divided by the benchmark return on positive S&P 500 days) and a 78% downside capture (strategy return divided by the benchmark return on negative S&P 500 days) would generate outperformance due to its ability to participate in positive market days while protecting capital on down days – Bahl & Gaynor’s objective. Even in the bull market period from 1983-1999 where 54.0% of days were positive, outperformance would theoretically still be achieved!

However, in the easy money, Quantitative Easing era of the 2010s decade through 2021, the percentage of up days was nearly two percentage points above the long-term average at 55.3%. Mathematically, active managers with risk-aware philosophies were at a disadvantage. Exhibit 2 illustrates the particularly extreme headwinds faced over the five-year period from 2017-2021, with 56.7% of days being positive – over three percentage points above the long-term average! While painful for many investors, 2022 was a year of mean reversion that overshot long-term averages to the benefit of quality and safety, and our strategies’ relative performance.

Bottom-line: It doesn’t take a bear market like 2022 to see risk-aware, dividend managers outperform… All it takes is reversion to long-term averages!

Volatility

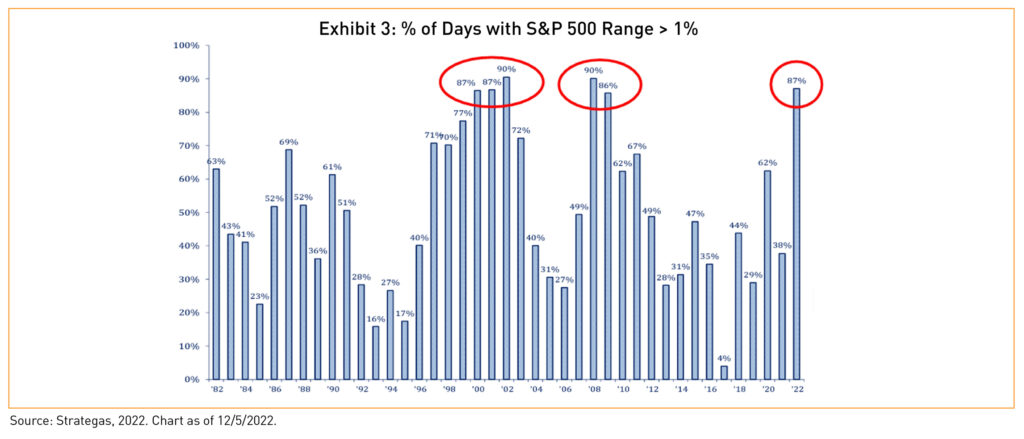

To the dismay of sell-side trading desks and their commission generation, buyside trading activity muddled through a decade of low volume and muted volatility as investors aptly learned to not “fight the Fed” and enjoyed the fruits of a “rising tide lifts all boats” market. In essence, the market’s discernment of fundamentals, valuation and even profitability mattered less, supporting a massive migration to passive investing.

This period of low volatility (Exhibit 3) also prevented active managers’ vital price-discovery effort in the marketplace and hindered opportunities to outperform an indexed/passive strategy. Just as easy money and low interest rates helped suppress risk in the equity market, the reversal of such efforts starting in 2Q2022 brought back volatility in a coiled spring-like way. Nearly 90% of S&P 500 trading days in 2022 have traded in a +/-1.0% daily range, providing massive opportunities for high-quality mandated strategies, including those at Bahl & Gaynor, to outperform.

According to Strategas, statistical replication to this data tends to occur in years that follow – high volatility years tend to come in bunches (e.g., think 2000-2003). Bottom-line: As return dispersion widens in the equity market, the opportunity for Bahl & Gaynor’s disciplined strategies to outperform expands.

Reflecting on a Challenging Market Year

For over 32 years, Bahl & Gaynor has prided itself in managing client capital in a responsible way. We seek to invest in companies that provide long-term dividend growth and positive risk-adjusted returns. Years like 2022 are difficult, even if one acknowledges this pain may be necessary in a well-functioning capital markets system.

Our team’s goal to provide downside market protection, upside market participation, and a consistent and growing level of dividend income shined in 2022. We extend our sincere gratitude to you, our clients and partners, for your continued loyalty and trust.