For Your Information

Identity Theft Rising Rapidly

$52B… that’s the estimated amount stolen from Americans last year by identity thieves.1 The number of cases reported to the Federal Trade Commission has grown every year for the last five years, fueled in 2020 by the pandemic. More of our personal information is now online; we continue to shop there, gather health information, and obtain benefits online, making us more vulnerable to credit card, medical and benefits fraud.

It’s interesting to note, baby boomers who are most likely to benefit from government programs are most susceptible to benefits fraud. It is younger generations, however, who experience the most identity theft; they’ve grown up with the internet, use credit cards and pay bills there. Credit card fraud is the leading form of ID theft.

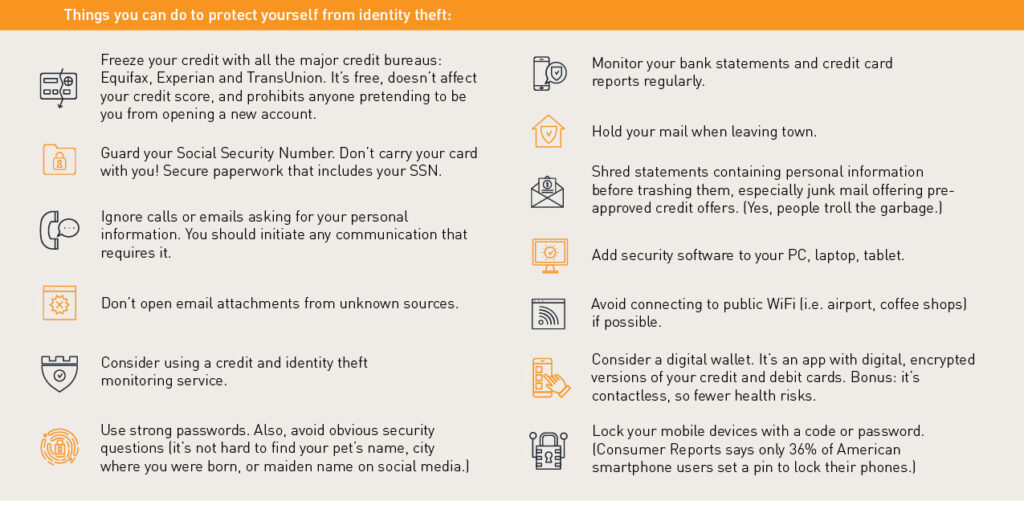

Account takeover is another illegal, but increasingly popular move where criminals steal money and/or access rewards from airlines, hotels, or merchants, even insurance policies. There are steps you should take to minimize the risk of fraudsters stealing your identity.

Bahl & Gaynor offers our clients instructions to follow should they believe they are victims of identity theft.

We’re happy to share them with you, HERE.

Meanwhile, here are some important tips:

¹ https://www.biometricupdate.com/202205/us-digital-id-fraud-cost-52b-in-2021-javelin-estimates

The information contained herein is true and complete to the best of our knowledge. Bahl & Gaynor offers it in good faith. All recommendations are made without guarantee on the part of the author or Bahl & Gaynor Investment Counsel.