Financial Planning

Dividends Paid Reach a New High

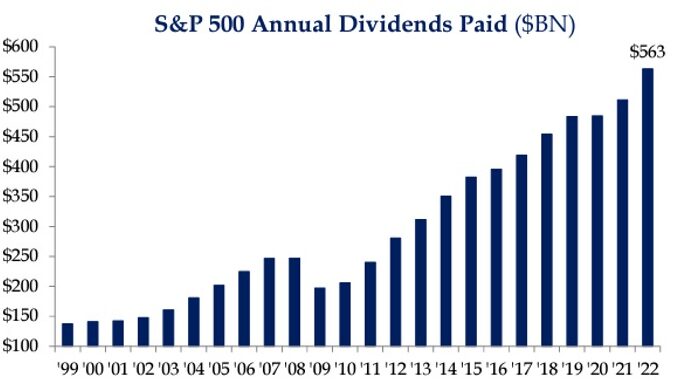

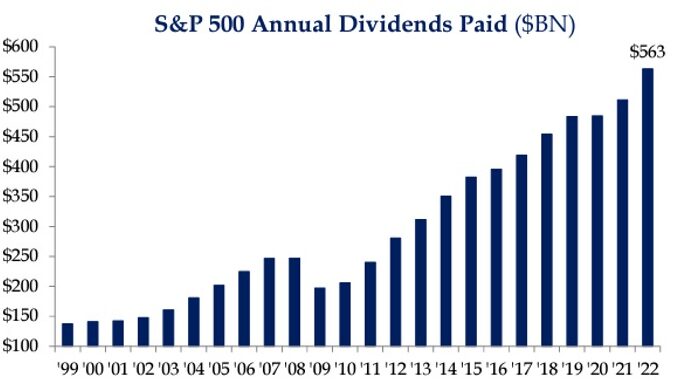

S&P 500 companies spent a record amount on dividends in 2022, giving shareholders a more immediate return on capital as this chart dating back to 1999 clearly displays:

Source: Strategas, January 18, 2023

It’s an increase of more than $50B over 2021 (the highest amount on record), with many analysts predicting dividend payments to increase yet again in 2023.1 History suggests dividend paying stocks weather volatility better than non-payers, fighting inflation.2

At Bahl & Gaynor, we are convinced dividends are a good way to supplement income and improve your portfolio’s growth potential. We’ve spent nearly 33 years refining our unique income growth, outcome driven approach based on long-term investment in carefully selected, high-quality, dividend growth equities. Our goal is to provide a growing stream of income for our clients to hedge against inflation and provide peace of mind as they save for retirement.

To learn more, call Bahl & Gaynor 513-287-6100, or reach us at info@bahl-gaynor.com.

Investment advisory services provided through Bahl & Gaynor (“B&G”), a federally registered investment adviser under the Investment Advisers Act of 1940. Registration does not imply Information or a certain level of skill or training. More information about B&G can be found by visiting www.adviserinfo.sec.gov and searching by the adviser’s name. This is prepared for informational purposes only and may not be applicable to your particular situation or need(s). It does not address specific investment objectives. Information in these materials are from sources B&G deems reliable, however we do not attest to their accuracy. No fiduciary relationship exists because of this commentary. Bahl & Gaynor does not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction. This document does not constitute advice or a recommendation or offer to sell or a solicitation to deal in any security or financial product.

An issuer of a security may be unwilling or unable to pay income on a security. Common stocks do not assure dividend payments and are paid only when declared by an issuer’s board of directors. The amount of any dividend may vary over time. Indices are unmanaged, hypothetical portfolios of securities that are often used as a benchmark in evaluating the relative performance of a particular investment. An index should only be compared with a mandate that has a similar investment objective. An index is not available for direct investment and does not reflect any of the costs associated with buying and selling individual securities or management fees. Principal risks of investing in Bahl & Gaynor strategies include stock market risk and recent market events risk. All investments inherently have aspects of risk associated with them; past performance is not guarantee of future results. As issuer of a security may be unwilling or unable to pay income on a security. Common stocks do not assure dividend payments and are paid only when declared by an issuer’s board of directors. The amount of any dividend may vary over time.