Financial Planning

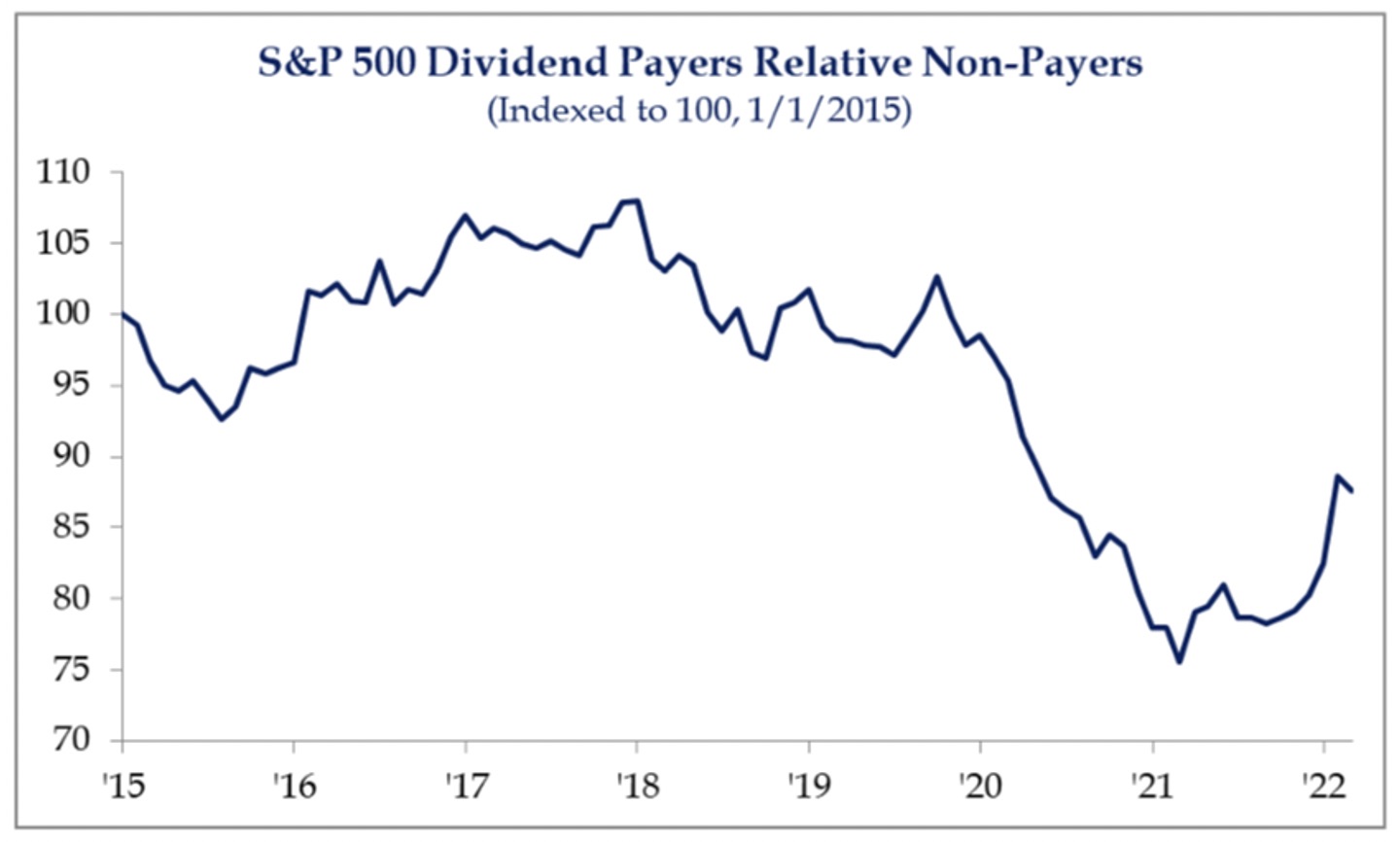

Dividend Payers Turning Up Sharply

At Bahl & Gaynor we’ve long believed “Dividends Pay Dividends.” Now, the Chief Investment Strategist at Strategas* uses current data to back up the belief. In a 2/15/22 investment strategy report, Strategas founder Jason Trennert wrote: “Dividend payers are greatly outperforming non-dividend payers this year. Higher and more variable inflation leaves the investor in all asset classes with reinvestment risk. Companies that provide their shareholders with regular cash flows allow them to reinvest the proceeds at higher yields.”

Trennert also notes given the current payout ratio, companies have room to raise dividends. He goes on to point out, this first quarter of 2022 will be the fourth quarter in a row with no suspension actions.

As the stream of money supplied by the government dries to a trickle, Trennert says he believes, “Dividends will be a significant part of investors’ total return from equities. We believe it is important to remember that dividends have made up nearly 60% of the total return on average each decade for the S&P 500 since 1930, even though share repurchases have largely replaced them as a tool to return money to shareholders in a tax-efficient matter.”

Looking forward Trennert says “Companies are far more likely to buy back shares as stocks go up rather than when they go down. That may have something to do with the idea that while share repos are like dating, dividends are like marriage.”

We stand resolute in our philosophy across strategies: invest in high quality businesses with underappreciated capabilities to compound capital and grow dividends over time.

You plan for a strong financial future for yourself and your family. Using your identified goals in a customized portfolio, we endeavor to get you there.

To learn more about protecting your wealth with Bahl & Gaynor, please reach out at info@bahl-gaynor.com, or call 513-287-6100.

Edward A. Woods, CFA

Portfolio Manager

*Strategas Research Partners is an institutional advisory firm providing macro research and capital markets & corporate advisory services for ultra and high net worth investors.

Investment advisory services provided through Bahl & Gaynor Investment Counsel (“B&G”), a federally registered investment adviser under the Investment Advisers Act of 1940. Registration does not imply Information or a certain level of skill or training. More information about B&G can be found by visiting www.adviserinfo.sec.gov and searching by the adviser’s name. This is prepared for informational purposes only and may not be applicable to your particular situation or need(s). It does not address specific investment objectives. Information in these materials are from sources B&G deems reliable, however we do not attest to their accuracy. Past performance is not indicative of future results. Indices and benchmarks are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment. Index return information is provided by vendors and although deemed reliable, is not guaranteed by B&G. No fiduciary relationship exists because of this commentary. If you have any questions regarding the indices or investments referenced in this presentation, contact your B&G investment professional.