Dividend Growth ESG

Sustainability: the core of Bahl & Gaynor’s investment philosophy Bahl & Gaynor specializes in the creation and management of high-quality, dividend growth equity portfolios emphasizing outstanding firm governance, earnings quality and long-term focus. Our mission of growing income through dividends is designed to unlock the power of financial freedom for our clients and includes many elements of sustainable investing.

Our Dividend Growth ESG strategy is one choice within our extensive assortment of investment opportunities. It answers a growing call from investors who want to see their money invested in a strategy that prioritizes environmental, social, and governance values. While at Bahl & Gaynor these values are always considered when choosing investments, in the Dividend Growth ESG strategy they are given top billing.

ESG Strategy Defined Environmental, Social and Governance (ESG) Integration is a holistic approach to sustainable investing which incorporates a wide range of principles. It assumes traditional financial analysis alone is not enough to judge the strength of a company; that the factors described below and long-term financial strength are often interconnected.

[icon_row]

[icon_block image=”https://www.bahl-gaynor.com/wp-content/uploads/2021/07/Environmental_icon.png”]Environmental Issues Include: climate change, pollution, waste management and hazardous materials use. [/icon_block]

[icon_block image=”https://www.bahl-gaynor.com/wp-content/uploads/2021/07/Social_icon.png”]Governance Issues Include: ethical business practices, Board structure (i.e. diversity and independence), executive pay and voting rights.[/icon_block]

[icon_block image=”https://www.bahl-gaynor.com/wp-content/uploads/2021/07/Governance_icon.png”]Social Issues Include: labor standards, community impact, diversity and inclusion, employee relations and working conditions. [/icon_block]

[/icon_row]

Bahl & Gaynor is committed to leading the way to a better investment world through integrating the evolving standards of outstanding corporate citizenship. Since our firm’s founding, we have provided clients with tailored socially responsible investment solutions to meet specific client requirements. We added the Dividend Growth ESG Strategy to our offerings in 2018, inspired by the wishes of our clients and knowing from experience that good corporate citizenship and strong financial results are not mutually exclusive. Bahl & Gaynor is a signatory of the Principles for Responsible Investing (PRI). This independent, United Nations- supported network helps signatories identify the investment implications of environmental, social and governance (ESG) factors and guides incorporation of these factors into our investment and ownership decisions. We are encouraged and excited by the support we see for this important evolution.

[alt_background background=”#f7fbf2″]

Our ESG Vision

Encouraged by the expectations of investors, Bahl & Gaynor believes companies will become better citizens of the world by;

Our ESG Mission

Using our dividend growth philosophy, the Bahl & Gaynor Investment Committee invests in companies displaying meaningful commitments to core ESG principles. Our intent is to increase our clients’ income and wealth while serving the community’s greater good.

Our ESG Purpose

Bahl & Gaynor takes seriously the stewardship of your funds and the sincerity of your intentions. We believe long term focus on sustainability can benefit people, the planet, and portfolio performance.

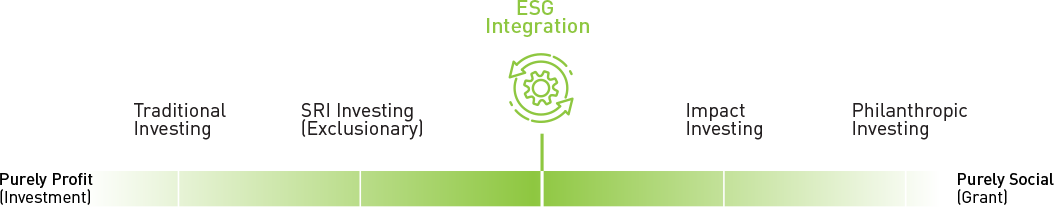

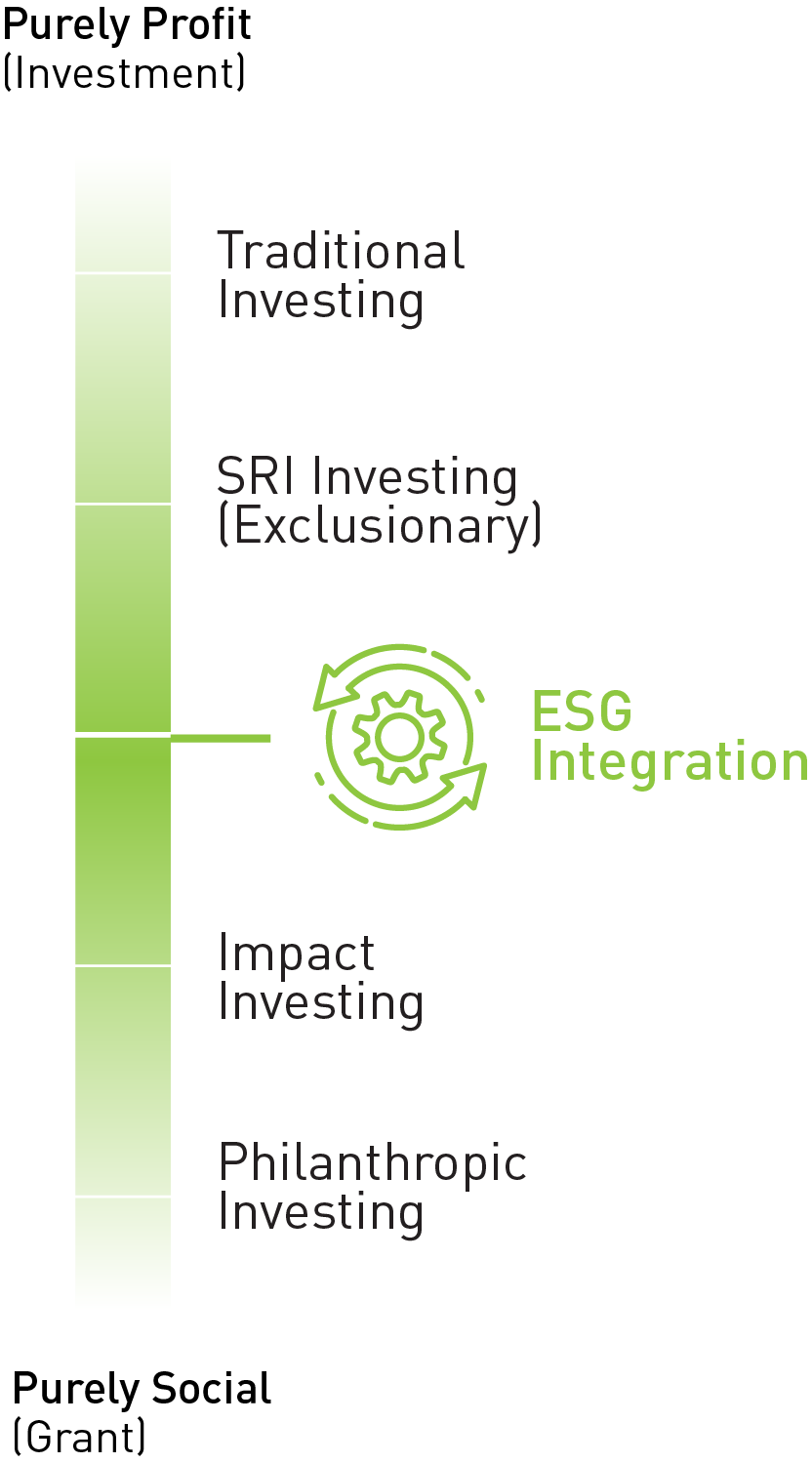

Bahl & Gaynor’s Dividend Growth strategy prioritizes an ESG integration approach, which balances the spectrum of priorities between purely profit-motivated (traditional investing) and purely socially-motivated (grant making) investment allocation.

• Socially Responsible Investing (SRI) applies constraints to investment choices, eliminating investments based on religion, personal values or political beliefs. Some negative screens may include addictive substances such as tobacco or alcohol, gambling, or firearms production.

• Impact Investing identifies the specific goals of a business or organization in an effort to create a positive result, such as a cleaner environment or treatment for a specific disease. Impact investors focus on generating measurable change, often with reduced financial return.

We apply ESG principles to our mission: to increase our clients’ income and wealth and help them achieve their goals. We invest in companies which demonstrate ESG leadership while they generate growing dividend income, provide downside protection and price appreciation potential.

As with all our strategies, at the heart of the Bahl & Gaynor ESG Strategy is YOU, the investor.

[/alt_background]

Dividend Growth ESG (Environmental, Social, and Governance)

1. ESG integration;

2. Generate current and growing income;

3. Provide downside protection; and,

4. Provide price appreciation potential

Over a full market cycle, Bahl & Gaynor’s Dividend Growth ESG strategy seeks to deliver benchmark-competitive performance with a lower-than-average portfolio risk profile. Client portfolios will generally be diversified among a selection of high-quality common stocks where low portfolio turnover combined with the favorable tax treatment of dividend income results in a cost and tax-efficient portfolio.

- Current dividend yield of 2.4%

- Average S&P earnings and dividend quality ranking of A-

- Weighted-average market capitalization of $207.9 billion

Top 10 Holdings | Portfolio Percentage | S&P Equity Quality Ranking |

PNC Financial (PNC) | 3.47% | A- |

Truist Financial (TFC) | 3.46% | B+ |

NextEra Energy (NEE) | 3.33% | A |

Marsh & McLennan (MMC) | 3.23% | A- |

Merck (MRK) | 3.01% | B- |

PepsiCo (PEP) | 3.00% | A- |

Air Products and Chemicals (APD) | 2.99% | A- |

Abbvie (ABBV) | 2.94% | NR |

Broadcom (AVGO) | 2.91% | NR |

Home Depot (HD) | 2.43% | A+ |