Financial Planning

New Record High for Dividend Payouts

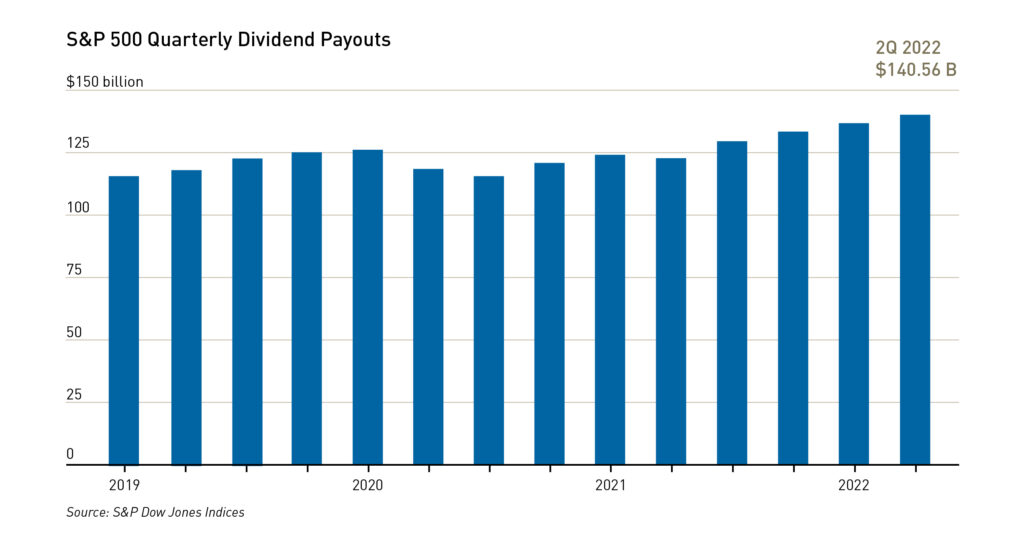

Our growing dividend philosophy proves itself anew. Despite a volatile 2022 market, income generating stocks continue to outperform non-dividend paying peers, setting another record in the second quarter.

In fact, according to a Bank of America analysis, dividends finished the first half of 2022 as the only investment factor with a positive return.1 Dividend payers are now restored to the levels they were before COVID. If inflation remains high and the Fed continues its tightening cycle, Goldman Sachs joins Bank of America and others in saying dividend paying companies are a good way to buttress portfolios.2

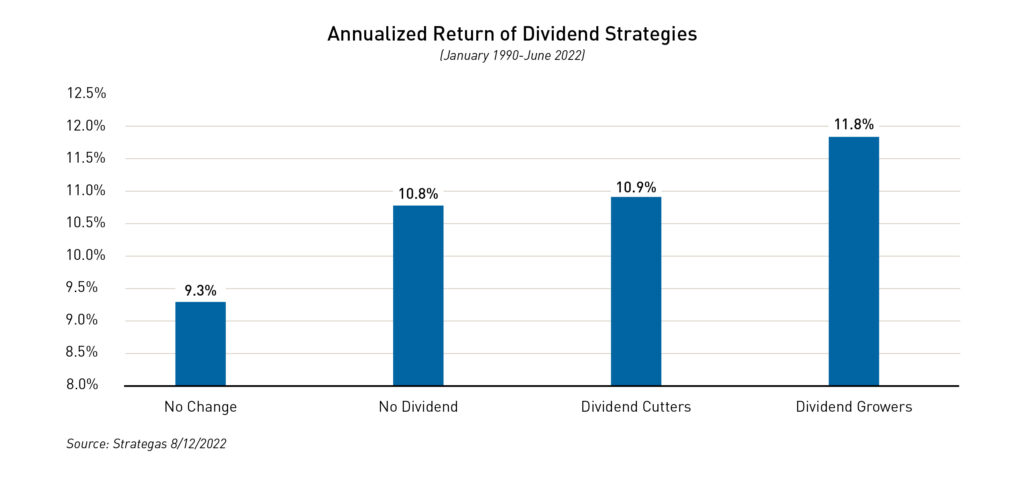

Given the rising interest rate and related negative impact on bond positions, our low volatility strategies’ outperformance is not surprising to Bahl & Gaynor portfolio managers, who know history supports our strategy. As illustrated in the chart below, for more than 30 years, companies growing their dividend have seen the strongest annualized return when compared with other dividend strategies.

An added benefit of course: less volatility. We believe dividend growth equities (Bahl & Gaynor’s specialty for 32 years) offer consistent growth, earnings, and peace of mind to our clients who seek stability amid concerns surrounding a potential recession.

Reliable Income = Reliable Outcome

1 https://www.wsj.com/articles/dividend-payouts-hit-record-despite-rocky-stretch-in-markets-11657618381?mod=hp_lead_pos2

2 https://www.reuters.com/markets/europe/volatile-us-markets-boost-appeal-dividend-stocks-2022-07-12/

Investment advisory services provided through Bahl & Gaynor Investment Counsel (“B&G”), a federally registered investment adviser under the Investment Advisers Act of 1940. Registration does not imply Information or a certain level of skill or training. More information about B&G can be found by visiting www.adviserinfo.sec.gov and searching by the adviser’s name. This is prepared for informational purposes only and may not be applicable to your particular situation or need(s). It does not address specific investment objectives. Information in these materials are from sources B&G deems reliable, however we do not attest to their accuracy. Past performance is not indicative of future results. Indices and benchmarks are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment. Index return information is provided by vendors and although deemed reliable, is not guaranteed by B&G. No fiduciary relationship exists because of this commentary. If you have any questions regarding the indices or investments referenced in this presentation, contact your B&G investment professional.